MoneyGuideElite℠

MoneyGuideElite℠ has been rated “the top choice of financial planning software for eight straight years,” according to Financial Planning Magazine’s annual survey. The MoneyGuideElite℠ program has partner integration with eMoney. For clients that are already using eMoney as an account aggregator to see all of their assets/liabilities in one place, GWS&A is able to link your living balance sheet directly into your MoneyGuideElite℠ Plan. This ensures that if your financial plan is reran or modified in the future, each new instance and scenario is based on a true and accurate representation of your current account values. At GWS&A, we feel that running a fee-based plan through this sophisticated software can help pre-retirees enter into retirement with additional confidence. The program is incredibly powerful for modeling “What if Scenarios”. MoneyGuideElite℠ uses Monte Carlo analysis and runs at minimum 100 trials to determine outcomes, based on stochastic modeling, the likelihood of success with variable stock market conditions. Depending on plan complexity, the GWS&A team spends 10 to 30+ hours from start to finish on the overall process. With this in mind, it is common that GWS&A may charge a separate for the service. Based on plan complexity, prices will vary, ranging from as little as $1,500 to $5,000+.

Additional modeling capabilities of MoneyGuideElite℠ include

(but not limited to):

Tax Planning

Determine a tax bracket filling strategies to minimize total tax over a lifetime

Gifting strategies

Roth conversion tax savings

Total Income Modeling

Secure Income Modeling

Advanced Lifetime Protection

Custom CMAs

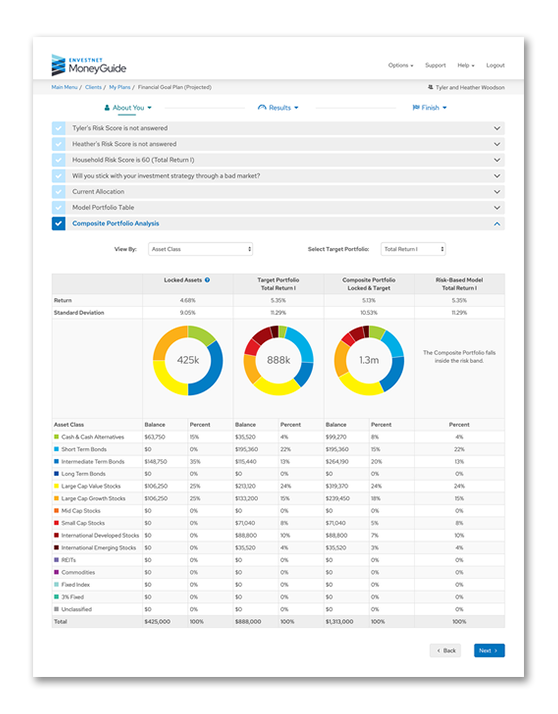

Sophisticated Risk Management Analysis

Life

Disability

Long Term Care

Custom Report Templates. We can tailor the pages you like the most out of hundreds to create custom meaningful reports to your liking

Action Item Summaries

Estate Planning

Calculate expected inheritance based on life expectancy

Calculate potential death taxes owed

Model various estate planning techniques to maximize wealth transfer.

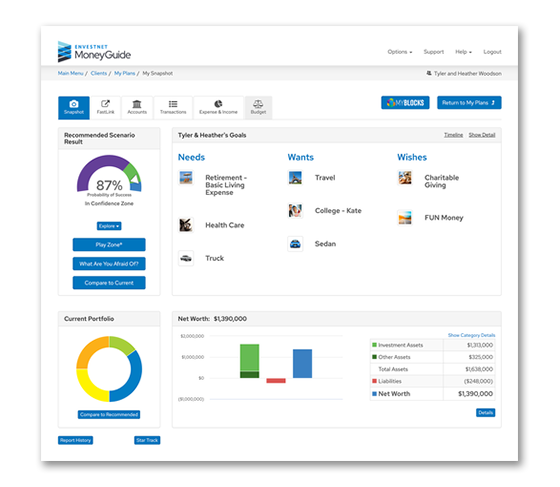

Client Planning Portal with guest access

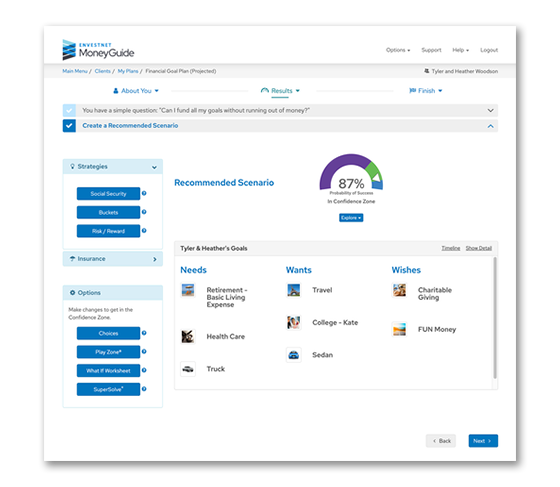

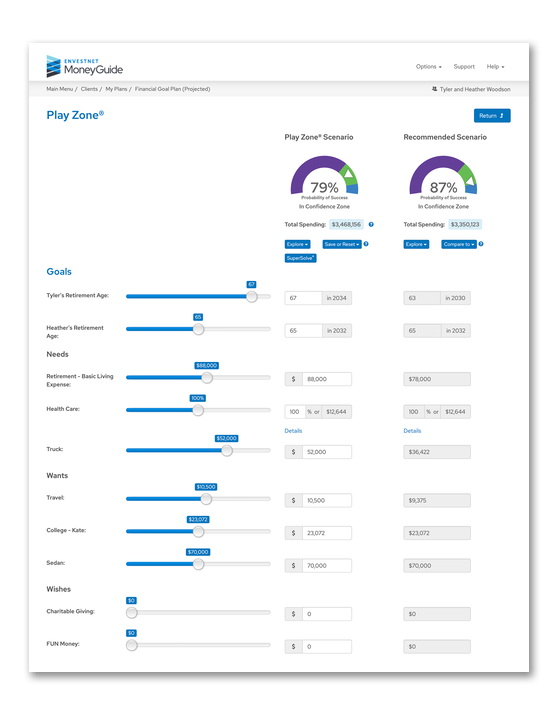

Test variables in PlayZone™

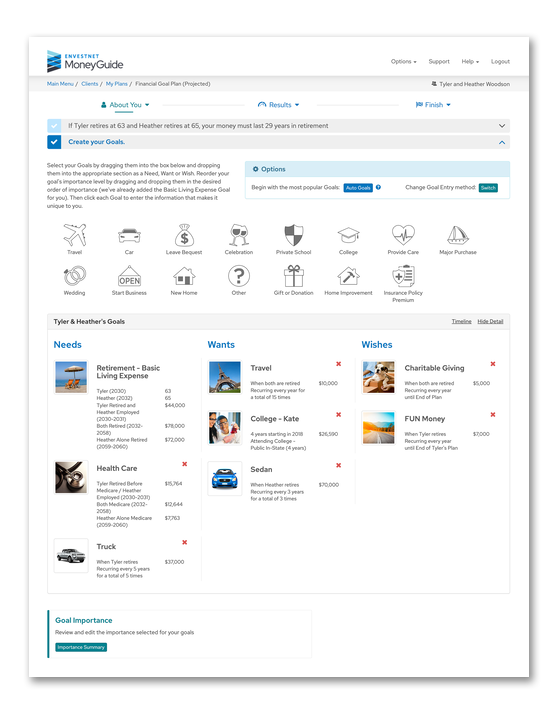

Create custom financial and legacy goals and calculate probability of success and then relate this to how it effects your retirement plan

Calculate Medicare costs based on your spenddown strategy of assets in retirement.

Holistic stress testing (bad timing, good trial run, median trial run, et al)

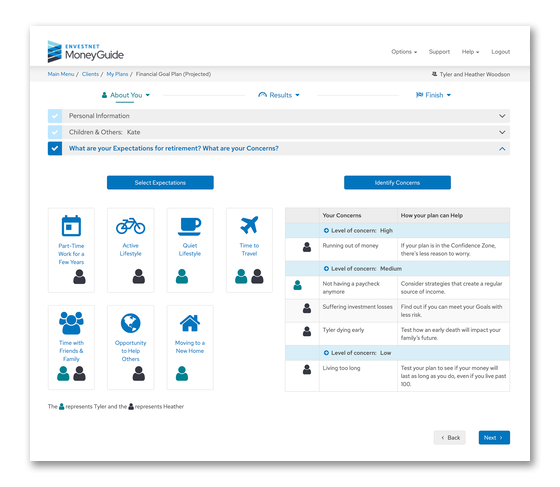

Risk tolerance (determine what effect increasing your cash positions has on your probability of successful retirement, determine if you take on additional portfolio risk how this effects probability of a successful retirement, etc.)

Some examples of what this new feature can help advisors show clients:

Roth Conversion: Show how converting a Traditional IRA or an Employer Retirement Plan to Roth Assets impacts your tax burden and the assets left to heirs. Based on the clients' projected taxable income during retirement, auto calculate the amount to convert that maximizes the use of a selected tax bracket.

Qualified Charitable Distribution (QCDs):

Show the impact on lifetime tax savings of gifting up to $100,000 of Qualified Retirement Assets directly to charities. Establish the amount to gift based on the client's projected Required Minimum Distribution.

Qualified Distribution:

Show the impact of taking distributions from Traditional IRA or an Employer Retirement Plan early in retirement rather than waiting until RMDs begin. Based on the clients' projected taxable income during retirement, instantly determine the amount that maximizes the distribution in years where there is lower taxable income.

These strategies are available in MoneyGuidePro® as Goal Strategies on the What If Worksheet. Interactive visual models to demonstrate these strategies in the plan are available in MoneyGuideElite℠.

DOWNLOAD OUR

RETIREMENT GUIDE NOW

Videos

Software Overview

MyBlocks: Protect Your Family

Platform Images